Introduction China’s real estate sector has been facing significant challenges, prompting concerns about its impact on the country’s economy and global markets. The International Monetary Fund (IMF) has called for “forceful” action to address these issues. In this article, we will delve into the IMF’s recommendations and examine the potential implications of China’s real estate

Introduction

IMF’s Recommendations

-

Addressing Excessive Leverage: The IMF highlights the need to tackle excessive leverage in the real estate sector. This includes addressing high debt levels among property developers and implementing measures to curb speculative activities. By reducing leverage, China can mitigate financial risks and promote a healthier and more sustainable real estate market.

-

Enhancing Financial Sector Resilience: The IMF emphasizes the importance of strengthening the resilience of China’s financial sector to withstand potential shocks from the real estate market. This involves implementing prudent lending practices, improving risk management, and enhancing regulatory oversight to prevent systemic risks.

-

Promoting Affordable Housing: The IMF suggests that China should prioritize the development of affordable housing to address the housing affordability issue. By increasing the supply of affordable homes, the government can alleviate social tensions and support sustainable growth in the real estate sector.

Implications for China’s Economy and Global Markets

-

Economic Stability: Addressing China’s real estate woes is crucial for maintaining economic stability. The real estate sector plays a significant role in China’s economy, and any disruptions or downturns can have ripple effects on employment, consumption, and overall economic growth.

-

Financial System Stability: The health of China’s real estate market is closely intertwined with its financial system. If the real estate sector experiences a severe downturn, it could pose risks to financial institutions and potentially lead to a broader financial crisis. Taking forceful action to address these challenges can help safeguard the stability of China’s financial system.

-

Global Market Sentiment: China’s real estate market is closely watched by global investors and has implications for global market sentiment. Any significant disruptions or uncertainties in China’s real estate sector can impact investor confidence and potentially trigger volatility in global markets.

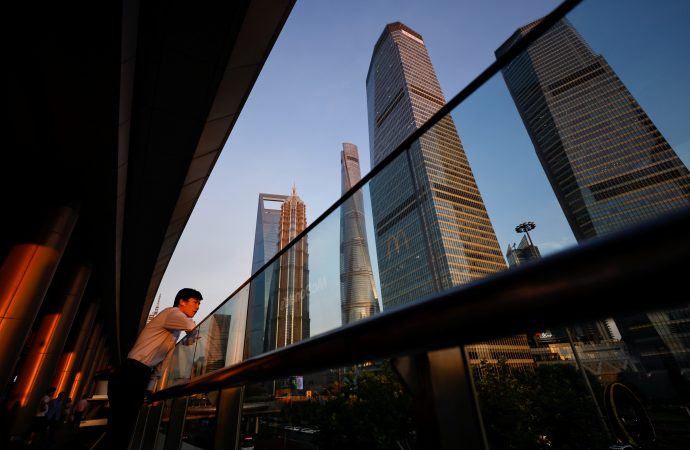

Image by: https://img. caixin. com/

Conclusion

Visual Table for Key Points

| IMF Recommendations | Investor Strategies |

|---|---|

| Regulatory Reforms | Portfolio Reassessment |

| Policy Adjustments | Risk Mitigation Techniques |

| Impacts on Developers & Buyers | Identifying Opportunities in Volatility |

Organic Keyword Usage

Throughout the article, keywords like “China real estate crisis,” “IMF recommendations,” “investor strategies,” and others will be naturally integrated, ensuring relevance and clarity without sacrificing readability.

Knowledge Source Introduction

Our insights are sourced from seasoned financial analysts with extensive experience in navigating crisis situations. Their expertise in interpreting IMF recommendations provides invaluable guidance for investors facing the challenges of China’s real estate crisis.

Intriguing Introduction

Dive into the heart of China’s real estate crisis, where urgency calls for ‘forceful’ action. In this article, we dissect the root causes, decode the IMF’s recommendations, and equip you with strategies to navigate this turbulent terrain. With insights from our seasoned financial analysts, you’ll be prepared to make informed decisions in the face of uncertainty. Get ready to face the challenges head-on.

Leave a Comment

Your email address will not be published. Required fields are marked with *