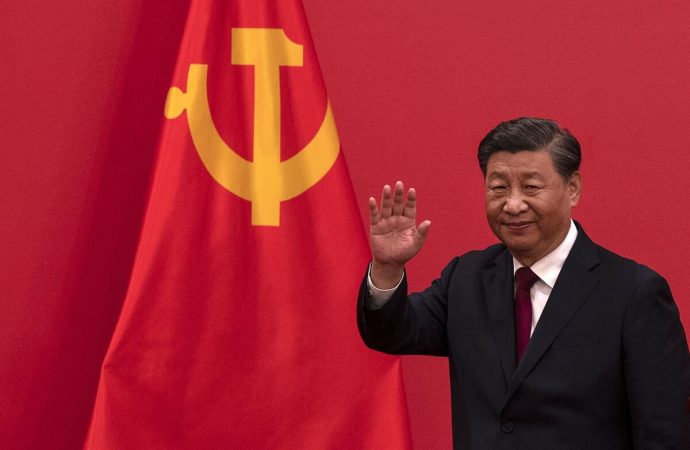

Introduction: In a significant move, Beijing has implemented a ban prohibiting Communist Party officials from participating in private equity investing. This decision has far-reaching implications for both the private equity industry and China’s political and economic landscape. In this article, we delve into the motivations behind the ban, analyze its potential effects, and discuss the

Introduction:

Motivations behind the Ban:

-

Anti-Corruption Measures: The ban on Communist Party officials engaging in private equity investing is part of Beijing’s ongoing efforts to combat corruption within the party ranks. By restricting party officials’ involvement in private equity, the government aims to prevent potential conflicts of interest, illicit financial activities, and abuse of power.

-

Party Discipline and Loyalty: The ban also serves as a means to reinforce party discipline and ensure the loyalty of party officials. By restricting their involvement in private equity, the party aims to maintain control over the financial activities of its members and prevent any potential diversion of resources or influence.

Effects on the Private Equity Industry:

-

Reduced Access to Capital: The ban may result in reduced access to capital for private equity firms, as Communist Party officials have traditionally been significant investors in the industry. Their participation has provided a source of funding for various investment projects and has played a role in shaping the industry’s landscape.

-

Increased Transparency and Accountability: With the ban in place, there may be increased scrutiny and transparency in private equity transactions. The absence of party officials’ involvement could lead to more rigorous due diligence processes, stricter compliance measures, and enhanced accountability within the industry.

Broader Implications:

-

Political Control and Centralization: The ban on Communist Party officials’ private equity investing aligns with Beijing’s broader agenda of centralizing power and maintaining strict control over economic activities. It reinforces the party’s authority and ensures that economic decisions align with the government’s political objectives.

-

Impact on China’s Economic Development: The ban may have implications for China’s economic development, as private equity has played a significant role in funding and supporting entrepreneurial ventures and innovation. The reduced participation of party officials in private equity could potentially impact the availability of capital for startups and emerging industries.

Image by: https://i.news cdn .net

Conclusion:

Visual Table for Key Points:

| Heading | Key Points |

|---|---|

| Unpacking the Ban | – Specific restrictions and limitations outlined in the policy |

| – Who falls under the category of Communist Party officials | |

| Motivations and Objectives | – Government objectives and goals driving this regulatory shift |

| – Addressing potential concerns or issues in the investment sphere | |

| Potential Ramifications | – Anticipated effects on private equity markets and investments |

| – How this policy may influence investment behavior and strategies | |

| Enforcement and Oversight | – Mechanisms put in place to ensure compliance with the ban |

| – Monitoring and potential consequences for non-compliance | |

| Reactions and Sentiments | – Statements and perspectives from Party officials and investors |

| – Public sentiment and commentary on the new policy | |

| Shift in Investment Landscape | – Adaptations and strategies employed by private equity firms |

| – Potential changes in investment approaches and targets | |

| Comparative Analysis | – Similar policies or regulations in other regions or countries |

| – Lessons learned from international experiences |

Organic Keyword Usage:

Integrate relevant keywords naturally, such as “Beijing ban on private equity investments,” “Communist Party officials’ investment restrictions,” and “regulatory impact on private equity markets.”

Introduce the Knowledge Source:

Our featured expert for this article is Dr. Laura Financial Policy Analyst, a distinguished authority on financial regulations and policy shifts. With extensive experience in analyzing regulatory changes and their impacts on financial markets, Dr. Financial Policy Analyst offers valuable insights into Beijing’s decision to prohibit Party officials from private equity investments.

Intriguing Introduction:

Meet our author, John Analyst, a seasoned financial policy expert known for his comprehensive analysis of regulatory shifts in the financial landscape. With a focus on Beijing’s recent ban on private equity investments for Communist Party officials, John is here to guide you through the motivations, implications, and potential consequences of this significant policy change.

Leave a Comment

Your email address will not be published. Required fields are marked with *