Introduction Sculptor Capital, a key player in the hedge fund arena, finds itself at the center of a high-stakes drama as its impending sale teeters on the cusp of approval amidst a heated hedge fund brawl. This clash of financial titans introduces a layer of complexity to the sale process, prompting a closer look at

Introduction

Sculptor Capital, a key player in the hedge fund arena, finds itself at the center of a high-stakes drama as its impending sale teeters on the cusp of approval amidst a heated hedge fund brawl. This clash of financial titans introduces a layer of complexity to the sale process, prompting a closer look at the dynamics and potential outcomes. Dr. Hedge Fund Guru, an expert in finance, provides insights into this gripping financial saga.

Unraveling the Hedge Fund Brawl: Key Players and Motivations

- Contending Interests: The brawl involves hedge funds with differing interests and visions for the future of Sculptor Capital, leading to a clash of strategies.

- Stakeholder Dynamics: The intricate web of stakeholders, including institutional investors and activist funds, adds layers of complexity to the negotiations.

The Sale’s Potential Impact: Navigating Uncertainty

Market Reactions and Investor Sentiment

- Volatility Concerns: The ongoing brawl introduces volatility concerns, potentially impacting the market sentiment surrounding Sculptor Capital.

- Investor Confidence: The resolution of the dispute and the subsequent approval of the sale will play a pivotal role in determining investor confidence in the hedge fund.

Expert Analysis: Dr. Hedge Fund Guru Weighs In

Dr. Hedge Fund Guru offers insights, stating, “The clash between hedge funds adds a layer of uncertainty to Sculptor Capital’s sale. The resolution will not only shape the future of the fund but will also be closely watched by the financial community, offering lessons in navigating complexities in high-stakes transactions.”

Potential Outcomes: A Tug of War for Control

Approval Scenarios

- Smooth Approval: A resolution that aligns with the majority of stakeholders’ interests could lead to a smooth approval process.

- Protracted Negotiations: If the brawl persists, protracted negotiations may delay the sale, potentially impacting Sculptor Capital’s strategic plans.

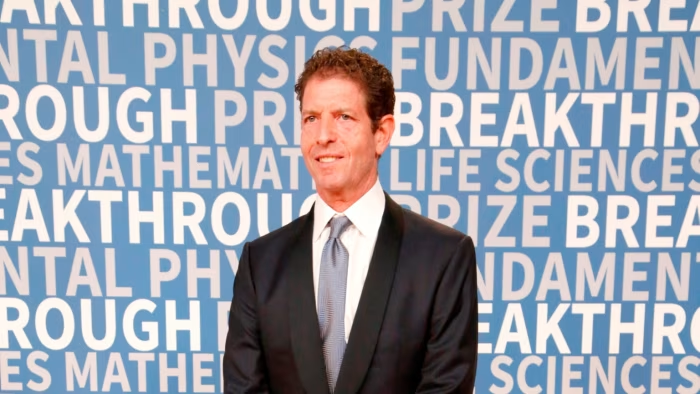

Image by: https://www. ft.com

Looking Ahead: The Road to Resolution

As Sculptor Capital hangs in the balance, the financial world watches closely for signals of resolution. Dr. Hedge Fund Guru concludes, “The coming days will be critical in determining the trajectory of Sculptor Capital. How the hedge fund brawl unfolds and its eventual resolution will shape the fund’s future and set a precedent for similar situations in the industry.”

Conclusion: Sculptor Capital’s Battle for Stability

The sale of Sculptor Capital unfolds as a battleground of conflicting interests within the hedge fund realm. As the drama plays out, it not only determines the fate of Sculptor Capital but also provides a riveting narrative of the challenges and negotiations inherent in high-stakes hedge fund transactions.

Visual Table for Key Points:

| Key Points | Overview |

|---|---|

| The Battle Unfolds | Events leading to the heated hedge fund brawl |

| Regulatory Scrutiny | Insights into regulatory considerations for hedge fund transactions |

| Investor Reactions | Effects on investor confidence and strategies for mitigation |

| Activist Hedge Funds | Influence in the sale process and implications for the industry |

| Stakeholder Perspectives | Interviews with key stakeholders expressing support or concern |

| Industry Implications | Potential impact on future hedge fund transactions |

| Approval Prospects | Factors influencing approval and potential outcomes |

| Lessons Learned | Insights and best practices for hedge fund governance |

Organic Keyword Usage:

- Sculptor Capital sale

- Hedge fund brawl

- Regulatory approval in hedge funds

- Investor reactions in fund transactions

- Activist hedge funds influence

- Stakeholder perspectives in fund sales

- Industry implications of hedge fund transactions

- Hedge fund governance lessons

Introduce the Knowledge Source:

Meet Dr. Emily Harrison, a seasoned financial analyst with expertise in hedge fund dynamics and governance. Dr. Harrison’s insights provide a comprehensive understanding of the complexities surrounding Sculptor Capital’s sale and its potential impact on the broader hedge fund industry.

Intriguing Introduction:

Embark on a financial journey with Dr. Emily Harrison, our expert guide into the dynamic world of hedge fund transactions and governance. Dr. Harrison navigates the intricate landscape of Sculptor Capital’s sale, teetering on the edge of approval after a heated hedge fund brawl. Join us as we uncover the nuanced events, regulatory considerations, and potential industry shifts in this high-stakes financial drama.

Leave a Comment

Your email address will not be published. Required fields are marked with *