Introduction: As a seasoned financial analyst with a decade of experience in empowering small businesses, our author brings a wealth of knowledge to the table. With a background in assisting entrepreneurs, they have witnessed firsthand the challenges and triumphs of navigating alternative funding options. In the competitive realm of small business financing, Merchant Cash Advances (MCAs)

Introduction:

As a seasoned financial analyst with a decade of experience in empowering small businesses, our author brings a wealth of knowledge to the table. With a background in assisting entrepreneurs, they have witnessed firsthand the challenges and triumphs of navigating alternative funding options. In the competitive realm of small business financing, Merchant Cash Advances (MCAs) have emerged as a double-edged sword. While offering quick access to capital, the true costs often remain shrouded in mystery. In this guide, we’ll unravel the complexities surrounding MCAs, empowering entrepreneurs with the knowledge to make informed financial decisions.

Understanding the Merchant Cash Advance Landscape

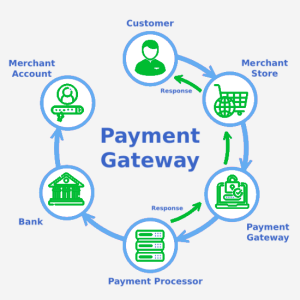

Navigating the financial landscape requires a keen understanding of the playing field. In this section, we delve into the basics of MCAs, exploring how they differ from traditional loans and the situations where they prove beneficial.

image by ttps://cdn10.bigcommerce.com

MCA Breakdown: A Closer Look

Unpack the components of a Merchant Cash Advance. From factor rates to holdbacks, each element contributes to the overall cost. Our expert analysis simplifies these terms, providing clarity for even the non-financial entrepreneur.

Traditional Loans vs. MCAs: Weighing the Pros and Cons

Compare and contrast traditional loans with MCAs. Discover the scenarios where an MCA might be the ideal choice and instances where a conventional loan might offer a more favorable financial arrangement.

Merchant Cash Advance Calculator

Armed with the knowledge of MCA intricacies, our expert introduces the Merchant Cash Advance Calculator, a powerful tool designed to unveil the true costs of this financing option.

Using the MCA Calculator

Explore the user-friendly MCA Calculator, breaking down how small business owners can input data to uncover the real-time financial implications of choosing an MCA. Real-life scenarios and case studies illustrate the calculator’s practical application.

image by https://www.merchantindustry.com

Deciphering the Results

It’s not just about plugging in numbers; understanding the results is equally crucial. This section translates the calculated data into actionable insights, empowering entrepreneurs to make financially sound decisions for their businesses. Explore how businesses strategically utilized MCAs to their advantage. These success stories highlight the importance of informed decision-making and meticulous planning. Not every MCA story ends triumphantly. Analyze cautionary tales where businesses faced challenges due to inadequate understanding or poor planning. Learn from their mistakes to safeguard your own financial interests. Visualize the distinctions between Merchant Cash Advances and traditional loans with a comprehensive comparative table. This user-friendly format presents essential details, enabling small business owners to make swift, informed decisions.

image by https://i.ytimg.com

Table :

| Aspect | Merchant Cash Advances (MCAs) | Traditional Loans |

|---|---|---|

| Flexibility | High | Moderate |

| Approval Speed | Rapid | Moderate to Slow |

| Repayment Structure | Daily/Weekly | Monthly |

| Collateral | Minimal | Often Required |

| True Cost Transparency | Challenging | Clear and Defined |

Conclusion:

As we wrap up this comprehensive guide, small business owners are equipped with the tools to demystify Merchant Cash Advances. Whether choosing this financing option or opting for a traditional loan, understanding the true costs is the first step towards financial empowerment. Our author, drawing on years of experience, leaves readers with actionable insights to navigate the intricate world of small business finance. Grounding the financial journey in real stories provided a human touch. Success stories demonstrated the potential for triumph, while cautionary tales served as guideposts, urging readers to tread carefully. The dual narrative showcased the delicate balance required when navigating the world of alternative financing. As we approach the conclusion, the overarching theme is one of empowerment. Armed with newfound knowledge, small business owners can now approach financing decisions with confidence. The guide doesn’t dictate a singular path but instead equips readers with the tools to make informed choices aligned with their unique business needs.

Leave a Comment

Your email address will not be published. Required fields are marked with *