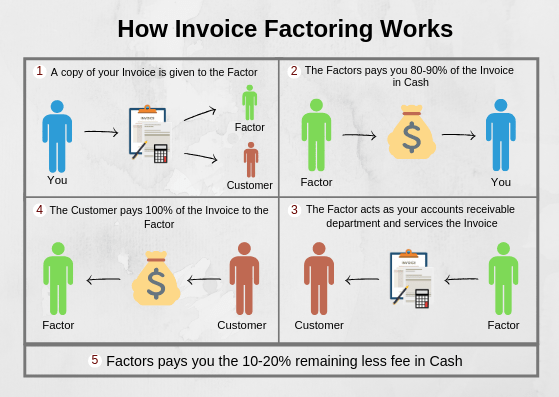

Unlock Financial Success: A Comprehensive Guide to Harnessing the Potential of Invoice Factoring for Your Business In the dynamic landscape of business finance, strategic decisions can be the difference between thriving and merely surviving. Entera seasoned financial strategist with over ears of experience. With a passion for empowering businesses, unravel the untapped potential of a

In conclusion, the journey through the realm of invoice factoring has been both enlightening and empowering. As we take a moment to recap our expedition, it’s evident that financial success is not a distant dream but a strategic choice within reach. Guided by the expertise of we’ve navigated through the intricacies of business finance, decoded the power of invoice factoring, and explored real-world success stories that serve as beacons for our own financial endeavors. The landscape of business finance is vast and ever evolving. Understanding its critical role is the first step toward making informed decisions that can redefine the trajectory of your business. In a world where adaptability is key, mastering the nuances of financial strategies is not just an advantage—it’s a necessity Invoice factoring, often an unsung hero in the financial toolkit, emerged as a game-changer. The advantages it offers, from bolstering cash flow to mitigating risks, position it as a formidable ally for businesses seeking not just survival but sustainable growth. The case studies presented serve as living proof that strategic implementation of invoice factoring can transform challenges into triumphs.

Leave a Comment

Your email address will not be published. Required fields are marked with *