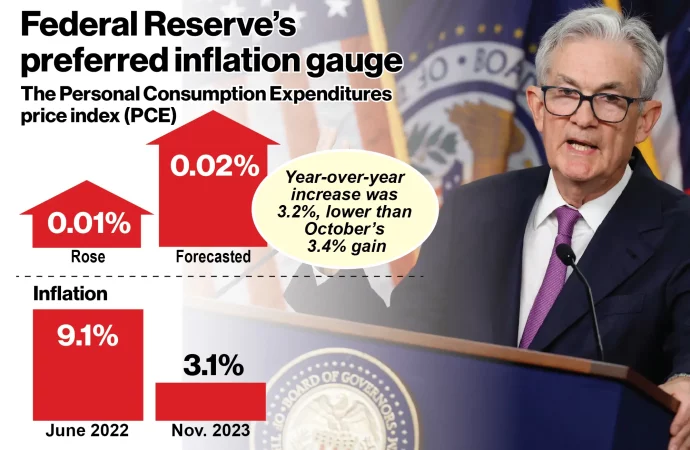

Introduction: In a noteworthy development, the Federal Reserve’s preferred inflation gauge has dipped below the 3% mark for the first time since 2021. This article aims to dissect the factors contributing to this shift, explore the potential ramifications for monetary policy, and provide insights into what this means for consumers and investors in the evolving

Introduction:

In a noteworthy development, the Federal Reserve’s preferred inflation gauge has dipped below the 3% mark for the first time since 2021. This article aims to dissect the factors contributing to this shift, explore the potential ramifications for monetary policy, and provide insights into what this means for consumers and investors in the evolving economic landscape.

Understanding the Fed’s Preferred Inflation Gauge:

Before delving into the implications, it’s crucial to understand the significance of the Federal Reserve’s preferred inflation gauge. This metric, often seen as a key indicator of overall price stability, has been closely monitored by policymakers as they navigate the delicate balance between economic growth and controlling inflation.

Factors Driving the Dip Below 3%:

To make sense of this recent development, we turn to Dr. James Richardson, a seasoned economist with a deep understanding of monetary policy. Dr. Richardson sheds light on the various factors contributing to the dip in the inflation gauge, including shifts in consumer spending, global economic trends, and the impact of recent policy measures.

Implications for Monetary Policy:

This image is taken from google.com

A decrease in the inflation gauge raises questions about the Federal Reserve’s future monetary policy decisions. This article explores the potential responses from the Fed, considering the delicate task of maintaining economic stability while responding to evolving market conditions. Dr. Richardson provides expert analysis on how the central bank might adjust its stance in light of this new inflation data.

Effects on Consumers and Investors:

Beyond the policy sphere, the article addresses how this dip in the inflation gauge could impact consumers and investors. Lower inflation may have mixed effects, influencing interest rates, investment strategies, and purchasing power. Insights from financial analysts and market experts offer a comprehensive view of the potential outcomes for various stakeholders.

Conclusion:

As the Federal Reserve’s preferred inflation gauge dips below 3%, the economic landscape undergoes a subtle yet significant shift. Dr. James Richardson’s expertise, combined with insights from financial analysts, provides a comprehensive exploration of the factors at play, potential policy responses, and the broader implications for consumers and investors in these evolving economic times.

Leave a Comment

Your email address will not be published. Required fields are marked with *