Peer-to-peer (P2P) lending has emerged as a transformative force in the financial sector. By directly connecting borrowers and lenders through digital platforms, P2P lending has disrupted traditional banking models. This article explores the future of P2P lending, analyzing its potential developments, challenges, and opportunities. Overview of Peer-to-Peer Lending Peer-to-peer lending is a form of direct

Peer-to-peer (P2P) lending has emerged as a transformative force in the financial sector. By directly connecting borrowers and lenders through digital platforms, P2P lending has disrupted traditional banking models. This article explores the future of P2P lending, analyzing its potential developments, challenges, and opportunities.

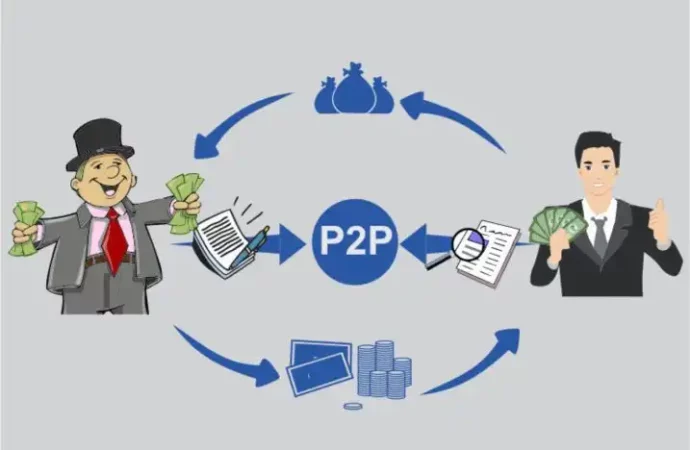

Overview of Peer-to-Peer Lending

Image by : Yandex

Peer-to-peer lending is a form of direct lending where individuals or businesses borrow money from other individuals or institutional investors through online platforms, bypassing traditional financial institutions. This system often provides borrowers with lower interest rates and lenders with attractive returns compared to conventional bank products.

Historical Context

The concept of P2P lending began gaining traction in the early 2000s with the advent of platforms like Prosper and Lending Club in the United States. These platforms allowed users to lend and borrow money on an unsecured basis, challenging traditional lending models and offering greater transparency and efficiency.

Current State of the P2P Lending Market

The P2P lending market has experienced significant growth over the past decade. According to industry reports, the global P2P lending market was valued at approximately $300 billion in 2023, with expectations to reach $500 billion by 2028. This growth is driven by increasing digital adoption, a rise in alternative investments, and a growing distrust of traditional banking systems.

Regional Analysis

The P2P lending market varies significantly across different regions:

- North America: Dominates the market with high adoption rates due to established platforms and favorable regulatory environments.

- Europe: Shows substantial growth, particularly in countries like the UK and Germany, with increasing regulatory support and a growing investor base.

- Asia-Pacific: Emerging as a significant player with rapid adoption in countries like China and India, driven by a large, underbanked population and rising financial literacy.

The Future Trends in Peer-to-Peer Lending

Blockchain technology is set to revolutionize P2P lending by enhancing transparency, reducing fraud, and lowering transaction costs. Smart contracts, which automate and enforce the terms of agreements, can increase the efficiency of loan processing and reduce the need for intermediaries.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are improving risk assessment and credit scoring. These technologies enable platforms to better predict borrower behavior, enhance creditworthiness evaluations, and personalize loan offers, leading to more accurate and efficient lending processes.

Regulatory Changes

As P2P lending grows, regulatory bodies are likely to impose stricter regulations to ensure consumer protection and market stability. This could include more rigorous standards for platform operations, disclosure requirements, and investor protections.

Global Harmonization

With the international expansion of P2P lending, there is a push towards global regulatory harmonization. Aligning regulations across borders could facilitate cross-border investments and create a more cohesive global P2P lending ecosystem.

Market Evolution

Image by : Yandex

Institutional investors are increasingly participating in P2P lending, attracted by the potential for higher returns. Their involvement can bring greater liquidity and stability to the market, but also introduces challenges related to market dynamics and investor expectations.

Integration with Traditional Financial Services

P2P lending platforms are exploring partnerships with traditional financial institutions to offer integrated financial solutions. This could lead to hybrid models where traditional banks and P2P platforms collaborate to provide a broader range of financial products and services.

Challenges Facing Peer-to-Peer Lending

Despite technological advancements, credit risk remains a significant challenge in P2P lending. Platforms must continuously refine their credit scoring models and risk management strategies to mitigate default rates and protect investor interests.

Platform Risk

The viability of P2P lending platforms themselves poses a risk. Platform failures or operational issues can impact both borrowers and lenders, necessitating robust platform governance and contingency planning.

Evolving Borrower and Lender Expectations

As the P2P lending market matures, consumer behavior is playing a crucial role in shaping its future. Borrowers are increasingly seeking more personalized and flexible loan options that align with their unique financial needs. P2P platforms are responding by offering tailored loan products and enhanced customer service. On the other hand, lenders are becoming more discerning, demanding greater transparency and higher returns. This shift in expectations is driving platforms to innovate and differentiate themselves, leading to a more competitive and customer-centric market. Platforms that successfully adapt to these evolving expectations will likely capture a larger share of the market and foster stronger borrower-lender relationships.

Impact of Financial Literacy

Image by : Yandex

The growth of P2P lending is also influenced by the level of financial literacy among consumers. As more individuals become financially educated, they are better equipped to understand and engage with alternative lending platforms. Increased financial literacy leads to more informed decision-making, reducing the risk of defaults and fostering a more robust lending environment. P2P platforms that invest in educational resources and tools to enhance financial literacy among their users will not only build trust but also contribute to a more stable and informed lending market. By empowering consumers with knowledge, P2P lending can become a more mainstream and trusted financial option.

Market Saturation

As the P2P lending market grows, increased competition and market saturation may compress margins and impact profitability. Platforms need to innovate and differentiate themselves to maintain competitive advantages and attract both borrowers and investors.

Comparative Analysis of P2P Lending Platforms

| Aspect | Platform A | Platform B | Platform C |

| Market Focus | Personal Loans | Small Business Loans | Real Estate Loans |

| Average Interest Rate | 5.5% | 7.0% | 4.0% |

| Loan Term | 1-5 years | 2-7 years | 6-12 months |

| Minimum Investment | $25 | $50 | $100 |

| Platform Fees | 1.0% | 1.5% | 1.2% |

| Credit Assessment | AI-Based | Manual | Hybrid (AI & Manual) |

Conclusion

The future of peer-to-peer lending holds promising potential as technology advances and the market evolves. Innovations such as blockchain, AI, and smart contracts are poised to enhance the efficiency and transparency of P2P lending. However, challenges related to risk management, regulatory changes, and market saturation must be addressed. As P2P lending continues to grow and integrate with traditional financial services, it has the potential to reshape the financial landscape, offering new opportunities for both borrowers and investors.

The evolution of P2P lending will likely be marked by increased institutional involvement, regulatory adjustments, and technological advancements, all contributing to a more dynamic and integrated financial ecosystem.