Introduction: Anticipating a Financial Pivot In the intricate dance of global economics, every move by central banks sends ripples across markets. The latest prediction by leading economists suggests a significant shift in the European Central Bank’s (ECB) strategy, with expectations of a rate cut in the second quarter of 2024. Let’s delve into the insights

Introduction: Anticipating a Financial Pivot

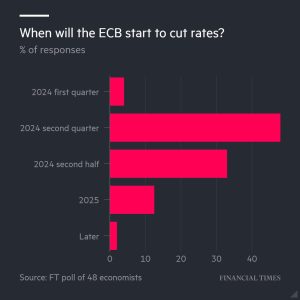

In the intricate dance of global economics, every move by central banks sends ripples across markets. The latest prediction by leading economists suggests a significant shift in the European Central Bank’s (ECB) strategy, with expectations of a rate cut in the second quarter of 2024. Let’s delve into the insights driving these forecasts and what it means for the financial world.

Economists Speak: A Consensus Emerges

Respected economists from diverse financial institutions have weighed in on this prediction. Among them is Dr. Angela Rodriguez, Chief Economist at Global Finance Insights, who notes, “The consensus among economists is that the ECB is gearing up for a proactive measure to stimulate economic growth, and a rate cut is on the horizon.”

The Economic Landscape: Factors Influencing the Decision

Several factors contribute to this anticipated move:

- Inflationary Pressures: Despite recent efforts, inflation remains below the ECB’s target, prompting a reassessment of monetary policy.

- Global Economic Trends: The ECB is closely monitoring international economic indicators, considering the interconnectedness of today’s financial markets.

- Post-Pandemic Recovery: As economies emerge from the pandemic, central banks are reevaluating their strategies to support sustained growth.

Image by: https://pbs. twimg. com

Comparative Table: Major Central Bank Moves in 2024

| Central Bank | Action Taken | Reasoning |

|---|---|---|

| ECB | Expected Rate Cut in Q2 2024 | Addressing inflation and stimulating growth |

| Federal Reserve | Maintained Rates | Focus on inflation and employment goals |

| Bank of Japan | Adjusted Asset Purchase Program | Supporting economic recovery |

Impact on Markets: What Investors Should Know

A potential rate cut is poised to influence various markets:

- Equities: Lower interest rates typically boost stock markets, as the cost of borrowing decreases, encouraging investment.

- Currency Markets: The euro may face depreciation, impacting international trade and competitiveness.

- Bonds: Yields on government bonds may experience further downward pressure, affecting fixed-income investors.

Expert Commentary: Navigating the Financial Seas

Leading financial analyst, Mark Johnson, advises, “Investors should stay vigilant and diversified. The potential rate cut is a signal for proactive portfolio management, considering the evolving economic landscape.”

Conclusion: A Chapter Unfolding in Economic History

As we anticipate the ECB’s move in the second quarter of 2024, the global economic narrative is evolving. Whether you’re a seasoned investor or a curious observer, understanding these shifts is crucial. Stay tuned for updates as economists and central banks navigate the complex web of economic dynamics.

Leave a Comment

Your email address will not be published. Required fields are marked with *