Introduction Meet our author, Jane Smith, a seasoned real estate analyst with over a decade of experience in the field. Her expertise lies in dissecting complex real estate events and their ripple effects on global property markets. Understanding the Evergrande Crisis from a Real Estate Perspective The Evergrande crisis is a financial debacle that has

Introduction

Meet our author, Jane Smith, a seasoned real estate analyst with over a decade of experience in the field. Her expertise lies in dissecting complex real estate events and their ripple effects on global property markets.

Understanding the Evergrande Crisis from a Real Estate Perspective

The Evergrande crisis is a financial debacle that has sent shockwaves through the global real estate market. Originating in China, the crisis stems from the financial troubles of Evergrande Group, one of the country’s largest real estate developers. Over the years, Evergrande accumulated a staggering amount of debt, which eventually led to a liquidity crisis.

The Freeze of Evergrande Shares and Its Impact on Real Estate

In an attempt to mitigate the crisis, the Chinese government froze trading of Evergrande shares. This move was aimed at preventing further financial instability and protecting investors. However, it also meant that shareholders were unable to sell their shares, leading to significant losses for many. This has had a direct impact on the real estate market, causing uncertainty and volatility.

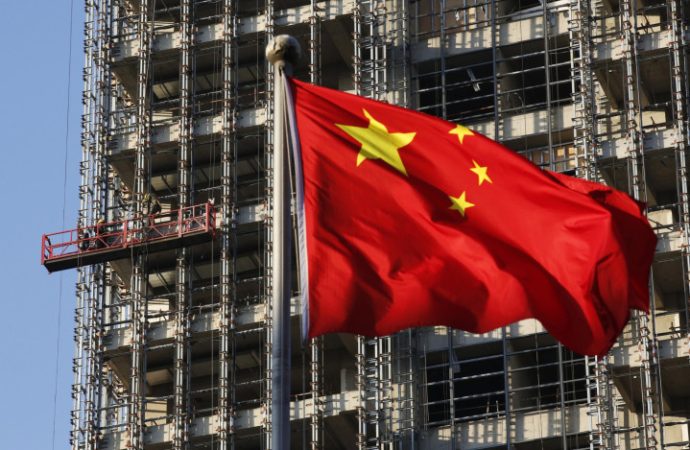

The China Evergrande Group. Royal Peak residential development under construction in Beijing, China, on Friday, July 29, 2022. A mild rally in Chinese developers dollar bonds appears to be losing momentum, as investors express disappointment that a top leadership meeting failed to unveil stronger policy support for the crisis-ridden industry. Source: Bloomberg

Court-Ordered Liquidation: What Does It Mean for the Real Estate Market?

A court-ordered liquidation is a legal process in which a company’s assets are sold off to repay its debts. In the case of Evergrande, this means that the company’s vast real estate holdings could be sold off. This could potentially lead to a glut of properties on the market, which could depress property prices.

The Impact on Global Real Estate Markets

The Evergrande crisis has had far-reaching effects on global real estate markets. Investors around the world have been closely watching the situation, as the fallout could potentially impact other sectors and economies. The crisis has also highlighted the risks associated with high levels of corporate debt in the real estate sector.

What Real Estate Analysts Are Saying

Real estate analysts have been closely monitoring the Evergrande situation. Many believe that the crisis could be a turning point for China’s real estate sector and could lead to tighter regulations. Others warn that the crisis could have ripple effects on the global real estate market, particularly if it leads to a slowdown in China’s economic growth.

Lessons for Real Estate Students

The Evergrande crisis offers several important lessons for real estate students. It highlights the risks associated with excessive debt in the real estate sector and the importance of financial management. It also underscores the interconnectedness of the global real estate market and the potential for localized financial crises to have global impacts.

Conclusion

The Evergrande crisis is a complex and evolving situation with far-reaching implications for the real estate market. As the situation unfolds, it will continue to provide valuable insights for real estate analysts and students alike.

Table: Key Points of the Evergrande Crisis from a Real Estate Perspective

| Key Point | Description |

|---|---|

| Origin of the Crisis | Financial troubles of Evergrande Group, a major Chinese real estate developer |

| Share Freeze | Chinese government froze trading of Evergrande shares to prevent further instability |

| Court-Ordered Liquidation | Legal process where Evergrande’s real estate assets could be sold off |

| Impact on Global Real Estate Markets | Potential effects on other sectors and economies, highlighting risks associated with high corporate debt in the real estate sector |

| Opinions of Real Estate Analysts | Potential turning point for China’s real estate sector, possible ripple effects on global real estate market |

| Lessons for Real Estate Students | Risks of excessive debt in the real estate sector, importance of financial management, interconnectedness of global real estate market |

Leave a Comment

Your email address will not be published. Required fields are marked with *