Introduction Kenya’s automotive sector is accelerating, and at its core lies a robust tire market serving passenger cars, commercial fleets, and two-wheelers. In 2024, the Kenya tire market reached USD 376 million, with forecasts projecting a 5.7% compound annual growth rate (CAGR) from 2025 to 2030. Rapid urbanization, expanded road infrastructure, and a booming logistics

Introduction

Kenya’s automotive sector is accelerating, and at its core lies a robust tire market serving passenger cars, commercial fleets, and two-wheelers. In 2024, the Kenya tire market reached USD 376 million, with forecasts projecting a 5.7% compound annual growth rate (CAGR) from 2025 to 2030. Rapid urbanization, expanded road infrastructure, and a booming logistics and e-commerce industry are key factors driving demand for high-quality tires. In this detailed analysis, we’ll examine market size, growth drivers, segment dynamics, competitive landscape, and future projections to 2030, providing insights for manufacturers, distributors, and investors.

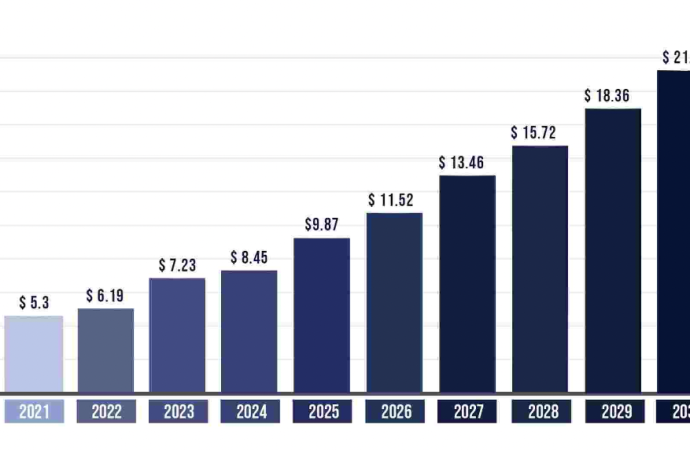

1. Market Size and Forecast

- 2024 Market Value: USD 376 million

- Projected CAGR (2025–2030): 5.7%

- 2025–2030 Forecast: Expected to exceed USD 511 million by 2030

Economic growth, rising disposable incomes, and increased vehicle ownership underpin this robust expansion, making Kenya a focal point for international tire brands and local players alike.

2. Key Market Drivers

2.1. Rising Vehicle Ownership

As Kenya’s economy grows, more households can afford private cars and motorcycles. New vehicle sales and a growing used-car market both fuel replacement tire demand.

2.2. Infrastructure Development

Major projects like the Nairobi–Mombasa Expressway and urban road upgrades improve connectivity but also increase tire wear, prompting more frequent replacements.

2.3. Logistics and E-Commerce Boom

The surge in online shopping and courier services has dramatically expanded the commercial vehicle fleet. Delivery vans and trucks require durable, high-performance tires to handle heavy loads and rough roads.

2.4. Two-Wheeler Proliferation

Motorcycles remain a cost-effective mobility solution. The two-wheeler tire segment is growing even faster than passenger-car tires as boda boda services and personal bikes multiply in urban and rural areas.

3. Market Segmentation

3.1. By Vehicle Type

- Passenger Car Tires: Over half the market volume, driven by private and ride-hailing vehicles.

- Commercial Vehicle Tires: Includes trucks, buses, and vans essential to logistics and public transport.

- Two-Wheeler Tires: Rapidly expanding segment due to the prevalence of motorcycles for transport and delivery.

3.2. By Tire Construction

- Radial Tires: Preferred for their longer life, better fuel efficiency, and improved safety.

- Bias-Ply Tires: Still used in heavy-duty agricultural and off-road applications for their tougher sidewalls.

3.3. By Distribution Channel

- Aftermarket Retailers: Local tire shops, national auto-service chains, and specialized tire centers form the largest distribution network.

- Original Equipment Manufacturer (OEM) Supply: Tires fitted on new vehicles at assembly plants.

- E-Commerce: Online platforms offering direct-to-consumer tire sales with home delivery gain traction for convenience and competitive pricing.

4. Competitive Landscape

4.1. Global Tire Manufacturers

- Michelin, Bridgestone, Continental, Goodyear: Dominate the premium segment with advanced technology, performance warranties, and robust dealer networks.

- Pirelli and Dunlop: Target performance-oriented and luxury vehicle owners.

4.2. Local and Regional Players

- Sameer Africa (Bridgestone Kenya): Local production and widespread distribution give it a strong market presence.

- Euclid Tyres and BKT Kenya: Focus on agricultural, industrial, and mining tires tailored to local conditions.

- Chinese Brands: Low-cost imports appeal to budget-conscious consumers, although quality and safety perceptions vary.

5. Pricing Trends

- Premium Tires: USD 100–200 per unit for popular passenger-car sizes.

- Mid-Range Tires: USD 60–100, balancing quality and affordability.

- Budget Tires: Below USD 60, targeting price-sensitive segments.

Raw material costs (rubber, oil) and foreign-exchange fluctuations continue to influence retail prices. Local assembly plants help manage costs by reducing import duties and logistics fees.

6. Regulatory and Environmental Factors

6.1. Quality and Safety Standards

The Kenya Bureau of Standards (KEBS) enforces mandatory tire approval and labeling requirements, ensuring that only certified products meet safety and performance criteria.

6.2. Tire Waste Management

Programs encourage tire retreading and proper disposal of end-of-life tires. Retreading plants extend tire life and reduce environmental impact, while recycling initiatives recover rubber and metal components.

7. Opportunities and Challenges

Opportunities

- Aftermarket Demand: Aging vehicle fleets increase replacement tire needs.

- Digital Sales Growth: E-commerce platforms provide convenient options and data-driven marketing.

- Green Tire Innovations: Low-rolling-resistance and sustainable materials attract eco-conscious fleet operators.

Challenges

- Gray Market Imports: Counterfeit and substandard tires undermine safety and brand reputation.

- Limited Local Manufacturing: Heavy reliance on imports exposes the market to supply-chain disruptions.

- Price Sensitivity: Many buyers opt for the cheapest option, constraining premium segment growth.

8. Technological Trends

- Smart Tires: Embedded sensors monitor pressure and temperature, enhancing safety and maintenance scheduling.

- Run-Flat Technology: Growing adoption among safety-conscious drivers who value mobility after punctures.

- Advanced Retreading: New rubber compounds and curing methods improve retread durability and performance.

9. Strategic Recommendations

- Expand Local Assembly: Partner with government incentives to build local tire plants, reducing costs and creating jobs.

- Invest in e-Commerce: Develop user-friendly online platforms with tire-fitting network directories.

- Promote Retreading: Educate commercial fleets on cost and environmental benefits of quality retreads.

- Strengthen Quality Assurance: Collaborate with KEBS to crack down on counterfeit tires and ensure consumer safety.

- Target Niche Segments: Develop specialized tires for agriculture, mining, and two-wheelers to capture high-growth areas.

Conclusion

The Kenya tire market, valued at USD 376 million in 2024 and projected to grow at 5.7% CAGR from 2025 to 2030, is driven by rising vehicle ownership, infrastructure expansion, and a booming logistics sector. While global brands continue to dominate the premium segment, local assemblers and budget imports fill key market gaps. The two-wheeler tire market outpaces overall growth, reflecting the importance of motorcycles in Kenyan transport. Opportunities lie in local manufacturing, digital sales, and advanced retreading, while challenges include gray-market imports and price sensitivity. By focusing on quality, innovation, and strategic partnerships, stakeholders can capitalize on Kenya’s expanding automotive landscape and steer the tire market toward long-term success.