Introduction The data on Quantitative Tightening (QT) is now at our disposal, offering a comprehensive look into its effects on financial markets. In this exploration, we dive into the recently released data, dissecting market reactions, identifying key trends, and shedding light on what this data signifies for investors in the ever-evolving economic landscape. Understanding Quantitative

Introduction

The data on Quantitative Tightening (QT) is now at our disposal, offering a comprehensive look into its effects on financial markets. In this exploration, we dive into the recently released data, dissecting market reactions, identifying key trends, and shedding light on what this data signifies for investors in the ever-evolving economic landscape.

Understanding Quantitative Tightening

Quantitative Tightening is the process by which central banks reduce the monetary stimulus by selling or allowing the expiration of the assets they acquired during Quantitative Easing (QE). The released data provides a nuanced view of how this reversal of expansionary monetary policy is shaping market dynamics.

Key Market Reactions

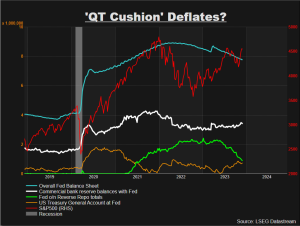

This image is taken from google.com

1. Interest Rate Movements:

The data reveals noteworthy shifts in interest rates, reflecting the central bank’s efforts to normalize monetary policy. Analyzing these movements provides insights into how financial institutions and investors are adjusting to changing yield environments.

2. Asset Price Volatility:

Changes in asset prices, particularly in bonds and equities, are evident in the data. Understanding the patterns of volatility offers a glimpse into investor sentiment and market resilience amid Quantitative Tightening.

Comparative Table: Quantitative Tightening Impact – Key Markets

| Market Indicator | Pre-QT Period | Post-QT Period | Trends and Observations |

|---|---|---|---|

| Interest Rates | [Pre-QT Rates] | [Post-QT Rates] | Shifts in short-term and long-term rates |

| Equity Markets | [Pre-QT Performance] | [Post-QT Performance] | Volatility, sector-wise performance |

| Bond Markets | [Pre-QT Yields] | [Post-QT Yields] | Yield curve changes, bond prices |

Expert Insights and Analyst Perspectives

This image is taken from google.com

Financial analysts offer diverse perspectives on the impact of Quantitative Tightening. Some emphasize the necessity of normalization for long-term economic health, while others caution about potential disruptions in financial markets. Understanding these viewpoints is crucial for investors seeking informed decision-making.

Implications for Investors

- Portfolio Diversification: The data underscores the importance of a well-diversified portfolio, especially in the face of increased market volatility.

- Adaptive Investment Strategies: Investors may need to reassess and adapt their investment strategies in response to changing interest rate environments and asset price dynamics.

- Monitoring Central Bank Communications: Statements from central banks play a pivotal role in shaping market expectations. Investors are advised to closely monitor and interpret official communications for potential market shifts.

Conclusion

As the data on Quantitative Tightening unfolds, investors are presented with valuable insights into the intricate dance between central bank policies and financial markets. Navigating this landscape requires a keen understanding of the observed trends, expert analyses, and a strategic approach to investment in a post-QT era. Stay tuned for continuous updates as the economic narrative evolves.