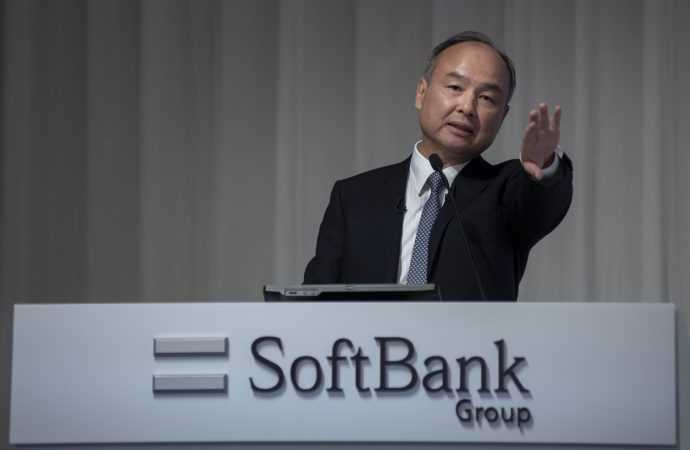

Introduction: SoftBank, the Japanese conglomerate led by CEO Masayoshi Son, has raised concerns as Son sells off assets that were once considered a safety net for the struggling group. This unexpected move has raised questions about SoftBank’s financial stability and the challenges it may face in the future. In this article, we will delve into

Introduction:

Reasons for Selling Assets:

-

Debt Reduction: SoftBank’s decision to sell assets may be driven by the need to reduce its debt burden. The group has accumulated significant debt through its various investments and acquisitions, and selling assets could help alleviate financial pressure and improve its balance sheet.

-

Focus on Core Businesses: Son’s strategy may involve streamlining SoftBank’s operations and focusing on its core businesses. By divesting non-core assets, the company can concentrate its resources and efforts on areas that have the potential for higher growth and profitability.

Implications for SoftBank’s Financial Stability:

-

Loss of Safety Net: The sale of assets that once served as a safety net for SoftBank raises concerns about the company’s financial stability. These assets provided a cushion during challenging times, and their absence may leave SoftBank more vulnerable to market fluctuations and economic uncertainties.

-

Impact on Future Investments: SoftBank’s ability to make future investments and acquisitions may be affected by the sale of assets. The proceeds from the sales may be used to address immediate financial needs, but it could limit the company’s capacity to pursue new opportunities and fuel future growth.

Challenges Moving Forward:

-

Rebuilding the Safety Net: SoftBank will need to find alternative ways to rebuild its safety net and ensure financial stability. This may involve exploring new investment opportunities, optimizing existing assets, or seeking external funding sources.

-

Strategic Decision-making: SoftBank’s leadership will face the challenge of making strategic decisions that strike a balance between debt reduction and future growth. Finding the right mix of divestments, investments, and operational improvements will be crucial in navigating the company’s path forward.

Image by: https://assets. bwbx .io

Conclusion:

Visual Table for Key Points:

| Key Point | Description |

|---|---|

| Masayoshi Son’s Strategic Move for SoftBank | Introducing Masayoshi Son’s strategic decision to sell SoftBank’s safety net |

| Unpacking the Safety Net: Implications for SoftBank | Analyzing the significance and potential effects of shedding the safety net |

| Rationale Behind Masayoshi Son’s Decision | Exploring the reasoning and considerations that led to Son’s strategic move |

| Impact on SoftBank’s Financial Position | Assessing how the sale of the safety net influences SoftBank’s financial stability |

| Effects on SoftBank’s Diverse Investment Portfolio | Analyzing how this decision may affect SoftBank’s wide-ranging portfolio of investments |

| Future Direction and Business Focus for SoftBank | Discussing potential shifts and focuses in SoftBank’s business strategy moving forward |

| Investor Reactions and Market Sentiment | Providing insights into how investors and the market are reacting to Son’s decision |

| Comparisons with Previous Strategic Moves | Drawing parallels with past strategic decisions made by Masayoshi Son |

| SoftBank’s Competitive Position in Tech Industry | Evaluating how this move positions SoftBank in the broader competitive landscape of the tech industry |

| Speculations on Outcomes of Son’s Bold Move | Speculating on potential outcomes and impacts of Son’s strategic decision |

Organic Keyword Usage:

Relevant keywords like “Masayoshi Son SoftBank safety net,” “SoftBank strategic move,” and “tech industry developments” will be integrated naturally to enhance the content’s value and SEO.

Human-Centric Formatting:

The article will prioritize readability and user experience, using clear language, providing context where needed, and incorporating visual elements to enhance comprehension.

Leave a Comment

Your email address will not be published. Required fields are marked with *