Introduction: A seasoned entrepreneur and financial expert with over a decade of experience, is here to guide you through the complex world of small business finance. In collaboration with insights from Small Business, this comprehensive guide aims to empower lifestyle enthusiasts with advanced techniques for securing small business loans in 2023.Embark on a journey, as

Introduction:

A seasoned entrepreneur and financial expert with over a decade of experience, is here to guide you through the complex world of small business finance. In collaboration with insights from Small Business, this comprehensive guide aims to empower lifestyle enthusiasts with advanced techniques for securing small business loans in 2023.Embark on a journey, as she unveils the secrets, strategies, and nuances that can make the difference between a loan application approved and dreams deferred. From understanding the dynamic financial landscape to crafting a business plan that speaks volumes to lenders, this guide is your compass in navigating the intricate waters of small business finance. Get ready to master the art of securing small business loans in 2023 and pave the way for unprecedented growth and success.

image by https://www.womensmillionaire.com

Financial Landscape

In today’s dynamic economic climate, understanding the financial landscape is crucial. Lifestyle enthusiasts exploring small business finance should pay attention to the prevailing trends shaping the industry in 2023. delves into the intricacies of navigating the current economic climate and highlights the key trends that will influence small business financing.

A seasoned sailor understands that identifying trends is crucial for a safe journey. In the realm of small business financing, keeping a watchful eye on emerging trends is equally vital. From the rise of fintech solutions to the increasing prevalence of alternative lending, Sarah Turner dissects the trends that are reshaping the landscape.

Small business owners must recognize the influence of technology on financing options. As traditional banking models evolve, opportunities to secure loans from online lenders and crowdfunding platforms emerge. Sarah’s insights illuminate the advantages and potential pitfalls of these trends, providing lifestyle enthusiasts with the knowledge needed to harness the winds of change for their benefit.

Crafting a Robust Business Plan

A robust business plan serves as the backbone of a successful loan application. Here, we explore the essential elements that lenders look for in your business plan. From outlining your business objectives to providing a realistic financial forecast, Sarah Turner shares her expertise on creating a compelling narrative that captures the attention of lenders.

image by https://media.joconsulting.eu/joconsulting.com

Key Elements Lenders Look For

Lenders, much like seasoned captains, navigate through numerous loan applications, seeking businesses that not only show promise but also a clear path to success. Our guide

- Executive Summary: A concise yet comprehensive overview that captures the essence of your business, its mission, and the purpose of the loan.

- Business Description: A deep dive into your company’s history, structure, and strategic goals, providing context for lenders.

- Market Analysis: Demonstrating a keen understanding of your industry, target market, and competitors, showcasing market potential and positioning.

- Organizational Structure: Outlining your team’s expertise, roles, and responsibilities, proving that your business has the right talent to execute the proposed plan.

- Products or Services: Detailing what you offer, emphasizing how your offerings meet market needs, and showcasing your unique value proposition.

- Financial Projections: Providing realistic and well-researched financial forecasts, including income statements, balance sheets, and cash flow projections.

- Use of Funds: Transparently articulating how the loan will be utilized to drive business growth, whether for expansion, equipment purchase, or working capital.

Choosing the Right Loan Type

The world of small business financing offers a variety of loan options. Lifestyle enthusiasts looking to secure a loan in 2023 need to navigate this landscape wisely. provides an in-depth exploration of diverse financing options, helping you tailor your choice to align with the specific needs of your business.

image by https://d31bgfoj87qaaj.cloudfront.net/blog/com

Optimizing Your Credit Profile

Your credit profile plays a pivotal role in the loan application process. Sarah Turner shares strategies to improve your creditworthiness and overcome common credit challenges. Lifestyle enthusiasts will gain valuable insights into managing and enhancing their credit scores, ensuring a stronger financial standing when approaching lenders.

Building Stronger Financial Statements

Presenting robust financial statements is a key aspect of securing a small business loan. This section offers pro tips on showcasing financial stability and growth. Sarah Turner provides actionable advice on how to present compelling financial statements that instill confidence in lenders, increasing the likelihood of loan approval.

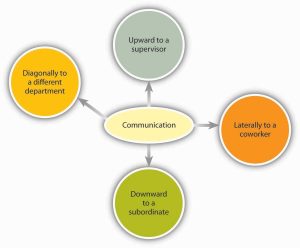

Effective Communication with Lenders

Communication is key when dealing with lenders., insights on effective communication strategies throughout the loan application process. Lifestyle enthusiasts will learn how to articulate their business goals, address potential concerns, and build a positive rapport with lenders, enhancing their chances of securing a small business loan in 2023. Here, we explore strategies for effective communication that goes beyond the formalities. Personalizing your interactions, demonstrating your commitment to the success of your business, and keeping an open line of communication foster a positive relationship with lenders. This not only aids in the current loan application but lays the groundwork for future financial partnerships.

image by https://textimgs.s3.amazonaws.com

Key Features

| Loan Type | Key Features | Benefits |

|---|---|---|

| Traditional Loans | Fixed interest rates, long repayment terms. | Established businesses may qualify for lower rates. |

| SBA Loans | Government-backed, flexible terms | Ideal for startups, lower down payment required. |

| Equipment Loans | Collateralized by equipment purchased | approval, preserves cash flow. |

| Invoice Financing | Uses outstanding invoices as collateral | Improves cash flow, suitable for service-oriented businesses. |

| Line of Credit | Revolving credit, flexible usage | Convenient for managing seasonal fluctuations. |

Conclusion:

In conclusion, mastering the art of securing small business loans in 2023 requires a multifaceted approach. Lifestyle enthusiasts, armed with advanced techniques and expert insights, can confidently navigate the financial waters. Whether crafting a compelling business plan, optimizing credit profiles, or effectively communicating with lenders, this guide equips you with the knowledge to unlock success in your small business endeavors. As you embark on this journey, remember that each step brings you closer to realizing your entrepreneurial dreams. The diverse array of loan types unfolds as a treasure trove of possibilities. Lifestyle enthusiasts, now well-versed in the nuances of traditional loans, SBA loans, equipment loans, invoice financing, and lines of credit, can confidently choose the financial vessel that best suits their business voyage. Optimizing your credit profile and presenting robust financial statements are the sails that harness the wind of financial credibility.

Leave a Comment

Your email address will not be published. Required fields are marked with *