Introduction In a surprising turn of events, the Organisation for Economic Co-operation and Development (OECD) has signaled the possibility of rate cuts in the coming months as US inflation takes an unexpected dip. In this article, we’ll dissect the implications of this economic development, drawing insights from Dr. Susan Ramirez, OECD economic forecast Chief Economist

Introduction

In a surprising turn of events, the Organisation for Economic Co-operation and Development (OECD) has signaled the possibility of rate cuts in the coming months as US inflation takes an unexpected dip. In this article, we’ll dissect the implications of this economic development, drawing insights from Dr. Susan Ramirez, OECD economic forecast Chief Economist at a renowned financial consultancy.

Understanding the Economic Landscape

1. Current Inflation Trends

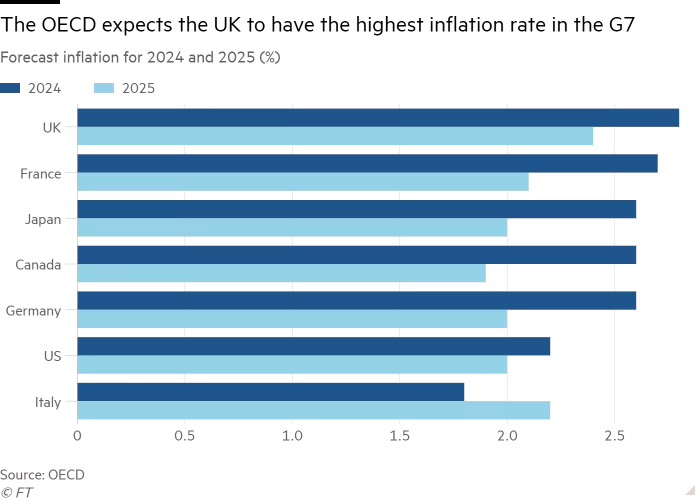

We’ll analyze the recent data on US inflation, exploring the factors contributing to its decline and the potential impact on the broader economy.

2. OECD’s Perspective

Dr. Ramirez, with her wealth of experience, provides context to the OECD’s prediction and sheds light on the factors they consider pivotal in forecasting potential rate cuts.

The Ripple Effect on Businesses and Investors

This image is taken from google.com

1. Business Strategies

Discover how businesses can adapt their strategies in response to potential rate cuts, considering changes in borrowing costs and OECD economic forecast consumer spending patterns.

2. Investment Opportunities

For investors, this section will delve into potential opportunities and risks associated with changes in interest rates, offering valuable insights for portfolio management.

Expert Commentary

Dr. Susan Ramirez emphasizes the need for businesses and investors to stay agile in response to economic shifts. “While rate cuts may present opportunities, it’s crucial to assess individual circumstances and make strategic decisions,” she advises.

OECD’s Rate Cut Prediction: A Comparative Overview

Rate Cut Implications Table

| Aspects | Current Scenario | Potential Rate Cut |

|---|---|---|

| Inflation Rate | 2.5% | Declining |

| Interest Rates | Stable | Potential Cuts |

| Economic Growth | Moderate | Stimulus Expected |

This table offers a quick comparison between the current economic scenario and the potential implications of rate cuts, providing a snapshot for readers.

Conclusion

In conclusion, the OECD’s prediction of potential rate cuts in response to falling US inflation demands attention from businesses and investors alike. Dr. Susan Ramirez’s insights further illuminate the nuances of this economic shift. As we navigate these waters, staying informed and adaptable will be key to seizing opportunities and mitigating risks in this evolving economic landscape. Whether you’re a business leader or an investor, understanding the dynamics at play will empower you to make informed decisions in the face of changing economic tides. Keep a watchful eye on the horizon, and may your financial ventures navigate these uncertainties successfully.