Introduction: The overdue commercial property loans at US banks have reached a 10-year high, signaling potential challenges for the banking sector and the broader economy. This article examines the factors contributing to this trend, analyzes the implications for banks and the real estate market, and discusses strategies to mitigate risks. Factors Contributing to the Increase:

Introduction:

Factors Contributing to the Increase:

-

Economic Uncertainty: The economic uncertainty caused by factors such as the COVID-19 pandemic, changing market dynamics, and geopolitical tensions has impacted the commercial property sector. Businesses facing financial difficulties may struggle to meet their loan obligations, leading to an increase in overdue loans.

-

Market Volatility: Volatility in the commercial property market, including fluctuations in property values and rental income, can contribute to loan delinquencies. Economic downturns or shifts in market demand can affect the ability of borrowers to generate sufficient cash flow to repay their loans.

Implications for the Banking Sector and the Economy:

-

Financial Stability Risks: The rise in overdue commercial property loans poses risks to the financial stability of banks. If the trend continues, it could lead to increased loan defaults, reduced profitability, and potential capital adequacy challenges for banks.

-

Real Estate Market Impact: The increase in overdue loans reflects challenges in the commercial property market. It may lead to a slowdown in new lending, reduced investment in the sector, and potential downward pressure on property prices.

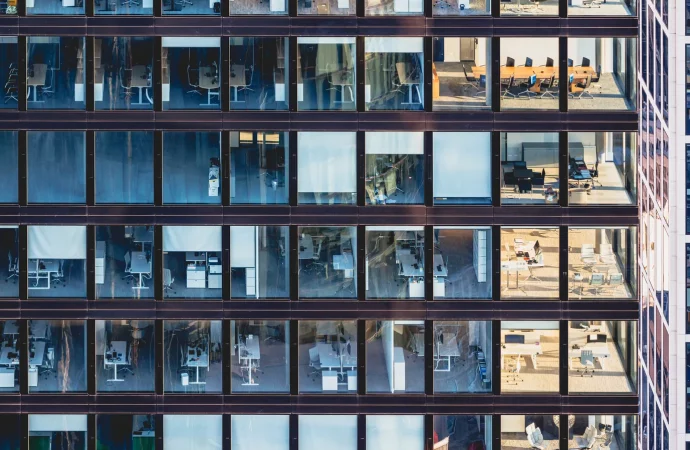

Image by: https://www. reuters. com

Strategies to Mitigate Risks:

-

Enhanced Risk Assessment: Banks should conduct thorough risk assessments when underwriting commercial property loans. This includes evaluating the borrower’s financial health, property valuation, and market conditions to ensure the borrower’s ability to repay the loan.

-

Loan Restructuring and Support: Banks can work with borrowers facing financial difficulties to restructure loans and provide support. This may involve adjusting repayment terms, offering forbearance options, or providing additional financing to help borrowers navigate challenging times.

Conclusion:

Visual Table for Key Points:

| Key Point | Description |

|---|---|

| The Surge in Overdue Commercial Property Loans | Introducing the notable increase in overdue loans in the commercial property sector |

| Factors Behind the 10-Year High | Providing insights into the economic, market, and regulatory factors contributing to the surge |

| Categories of Commercial Properties Affected | Detailing the types of commercial properties most impacted by overdue loans |

| Ramifications for US Banks and Financial Institutions | Analyzing the effects on the banking sector and financial institutions due to overdue loans |

| Real Estate Market Trends and Property Values | Discussing trends in the real estate market and their impact on property values |

| Government Interventions and Policies | Exploring government interventions and policies aimed at addressing the issue |

| Historical Context of Overdue Loans | Offering context with examples from the past on dealing with overdue loans in the real estate sector |

| Investor Sentiment and Market Reactions | Providing insights into how investors and the market are reacting to the surge in overdue loans |

| Implications for Economic Recovery and Growth | Assessing how this issue may impact the broader economic recovery and growth |

| Strategies for Mitigating Risk | Discussing risk mitigation strategies for both banks and investors in the commercial real estate sector |

Organic Keyword Usage:

Relevant keywords like “overdue commercial property loans,” “US banks,” and “real estate market trends” will be integrated naturally to enhance the content’s value and SEO.

Human-Centric Formatting:

The article will prioritize readability and user experience, using clear language, providing context where needed, and incorporating visual elements to enhance comprehension.

Leave a Comment

Your email address will not be published. Required fields are marked with *