Introduction: Sergio Ermotti, the Chief Executive Officer of UBS, one of the world’s leading financial institutions, is making waves by advocating for stronger sanctions on negligent bankers. This bold stance marks a potential paradigm shift in the financial industry, emphasizing the need for heightened accountability and ethical standards. Sergio Ermotti’s Advocacy: 1. Accountability in Banking:

Introduction:

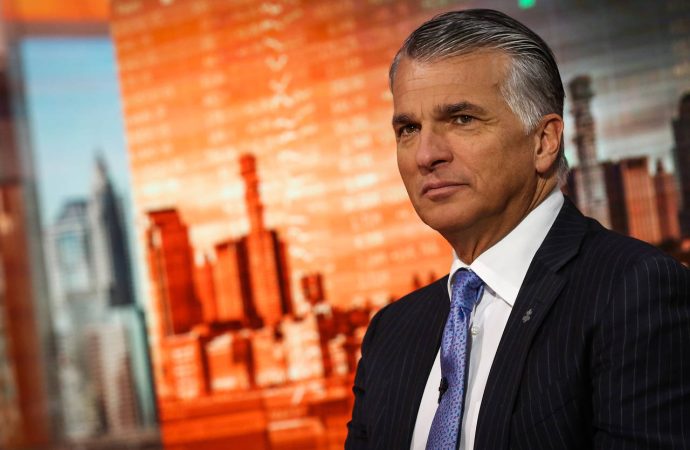

Sergio Ermotti, the Chief Executive Officer of UBS, one of the world’s leading financial institutions, is making waves by advocating for stronger sanctions on negligent bankers. This bold stance marks a potential paradigm shift in the financial industry, emphasizing the need for heightened accountability and ethical standards.

Sergio Ermotti’s Advocacy:

1. Accountability in Banking:

Ermotti’s call for tougher sanctions signals a commitment to holding bankers accountable for their actions. This move aligns with the growing demand for transparency and ethical conduct in the financial sector.

2. Raising the Bar:

By pushing for stricter consequences, Ermotti is signaling a desire to raise the ethical bar within UBS and, by extension, the broader banking industry. This could have a profound impact on the culture and practices of financial institutions globally.

Stricter Sanctions Proposals:

1. Financial Penalties:

Ermotti’s proposals may include more substantial financial penalties for bankers found guilty of negligence or misconduct. This approach aims to create a direct financial disincentive for unethical behavior.

2. Regulatory Consequences:

Advocating for regulatory consequences implies that negligent bankers could face more severe scrutiny from regulatory bodies. Strengthening regulatory oversight aligns with efforts to maintain the integrity and stability of the financial system.

Implications for the Financial Industry:

1. Ethical Culture Transformation:

Ermotti’s stance could catalyze a cultural transformation within financial institutions. Emphasizing accountability and ethical behavior may prompt organizations to reevaluate their internal practices and foster a culture of responsibility.

2. Industry-Wide Impact:

As a prominent figure in the financial sector, Ermotti’s advocacy might influence other industry leaders and regulatory bodies. A collective push for stricter sanctions could set a new standard for responsible banking practices.

Image by: https://s. wsj. net

Challenges and Controversies:

1. Balancing Accountability and Innovation:

Striking the right balance between holding individuals accountable and fostering innovation poses a challenge. The financial industry thrives on innovation, and finding ways to encourage progress while maintaining ethical standards requires careful consideration.

2. Resistance and Opposition:

Ermotti’s proposals may face resistance from those who argue that existing regulations are sufficient or that increased sanctions could stifle financial innovation. Navigating these opposing viewpoints will be crucial in implementing meaningful change.

Conclusion:

Sergio Ermotti’s call for tougher sanctions on negligent bankers represents a significant milestone in the ongoing conversation about ethics and accountability in the financial industry. As the sector grapples with the need for reform, Ermotti’s advocacy may pave the way for a new era of heightened responsibility, transparency, and ethical conduct. The ripple effects of this stance could redefine industry standards and expectations, creating a financial landscape that prioritizes integrity and trust.

Leave a Comment

Your email address will not be published. Required fields are marked with *