Unlocking Financial Efficiency, the Mechanics of Decoding Invoice Factoring Introduction In the intricate realm of finance, where businesses constantly seek avenues for improved efficiency, one strategy stands out—invoice factoring. This financial mechanism, often shrouded in mystery, has the power to revolutionize cash flow and mitigate risks. Join us on a journey guided by Jane Reynolds,

Unlocking Financial Efficiency, the Mechanics of Decoding Invoice Factoring

Introduction

In the intricate realm of finance, where businesses constantly seek avenues for improved efficiency, one strategy stands out—invoice factoring. This financial mechanism, often shrouded in mystery, has the power to revolutionize cash flow and mitigate risks. Join us on a journey guided by Jane Reynolds, a distinguished financial analyst, as we decode the mechanics of invoice factoring and unveil its transformative potential.

Understanding Invoice Factoring

Fundamentals

To embark on this exploration, it’s crucial to grasp the basics of invoice factoring. At its core, invoice factoring involves turning outstanding invoices into immediate working capital. Jane breaks down the fundamental concepts, emphasizing how businesses can leverage this strategy to unlock trapped funds.

Mechanics at Play

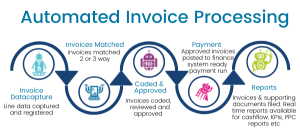

The intricacies of invoice factoring unfold through a series of well-defined steps. From the submission of invoices to the moment funds are received, Jane unravels the mechanics at play. Businesses, factors, and clients engage in a financial dance that, when orchestrated correctly, can lead to unparalleled financial efficiency.

image by https://www.documation.com

Advantages of Invoice Factoring

Boosting Cash Flow

One of the primary attractions of invoice factoring is its ability to boost cash flow. Jane paints a vivid picture using real-world examples, showcasing how businesses—from startups to established enterprises—have experienced a significant positive impact on their liquidity.

Mitigating Financial Risks

Beyond cash flow, invoice factoring serves as a strategic tool for mitigating financial risks. As businesses navigate uncertainties, Jane explains how this financial strategy acts as a shield, offering a layer of protection against potential setbacks.

Choosing the Right Partner

Not all factoring partners are created equal. Jane outlines the critical factors businesses should consider when selecting a factoring partner. Choosing the right ally is paramount for a successful and mutually beneficial factoring relationship.

Hidden Costs and Pitfalls

While the benefits of invoice factoring are clear, it’s equally essential to navigate the potential challenges. Jane sheds light on hidden costs and common pitfalls, providing readers with insights to make informed decisions and avoid potential stumbling blocks.

image by https://i.pinimg.com

Key Points

| Key Point | Description |

|---|---|

| Fundamentals of Factoring | Grasping the basic concept of invoice factoring. |

| Mechanics at Play | Understanding the step-by-step process from submission to funding. |

| Boosting Cash Flow | Real-world examples showcasing the positive impact on cash flow. |

| Mitigating Financial Risks | Leveraging factoring as a strategic tool for risk management. |

| Choosing the Right Partner | Criteria for selecting the ideal factoring partner. |

| Hidden Costs and Pitfalls | Addressing potential challenges, costs, and how to avoid pitfalls. |

Conclusion

we bring our journey through the intricacies of invoice factoring to a close, it’s evident that this financial strategy holds the key to unlocking a new era of efficiency for businesses. Jane Reynolds, our guide in this exploration, has unraveled the mechanics, advantages, and considerations surrounding invoice factoring, providing a comprehensive understanding of its transformative potential. At the heart of the allure of invoice factoring lies its ability to revolutionize cash flow dynamics. The real-world examples shared by Jane underscore how businesses, regardless of their size or industry, can experience a tangible and positive impact on liquidity. This shift in cash flow can be a game-changer, offering newfound flexibility and resilience. Beyond the immediate financial gains, invoice factoring emerges as a strategic tool for mitigating financial risks. In an era where uncertainties are inevitable, businesses need more than just financial solutions—they need robust risk management strategies. Jane’s insights highlight how invoice factoring can act as a shield, providing a layer of protection against the unpredictable twists and turns of the business landscape.

Leave a Comment

Your email address will not be published. Required fields are marked with *