Introduction As the financial landscape undergoes a rapid digital transformation, the call for modernizing US bank regulation becomes increasingly urgent. This article delves into the imperative for updating the regulatory framework, identifies key areas in need of transformation, and explores the potential benefits of ushering in a new era of regulation aligned with the demands

Introduction

As the financial landscape undergoes a rapid digital transformation, the call for modernizing US bank regulation becomes increasingly urgent. This article delves into the imperative for updating the regulatory framework, identifies key areas in need of transformation, and explores the potential benefits of ushering in a new era of regulation aligned with the demands of the digital age.

The Digital Imperative

1. Evolving Financial Ecosystem:

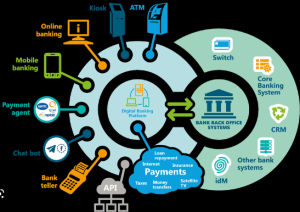

The digital age has ushered in a dynamic and interconnected financial ecosystem, challenging the traditional paradigms of banking. Cryptocurrencies, online banking, and fintech innovations necessitate a regulatory framework that can effectively navigate this evolving landscape.

2. Cybersecurity Threats:

With the rise of digital banking comes an increased vulnerability to cybersecurity threats. Modernizing bank regulation is crucial to fortifying the sector against cyber risks, safeguarding sensitive financial information and ensuring the resilience of the financial system.

Key Areas for Transformation

This image is taken from google.com

1. Regulatory Agility:

Traditional regulatory processes often struggle to keep pace with the rapid changes in the financial industry. An agile regulatory framework, capable of adapting swiftly to emerging technologies and trends, is essential for effective oversight.

2. Data Protection and Privacy:

The digital age emphasizes the need for robust data protection and privacy measures. Modernized regulation should address how banks handle, store, and share customer data, aligning with contemporary expectations for privacy and security.

Comparative Overview: Global Regulatory Approaches

| Country/Region | Regulatory Approach | Key Focus Areas |

|---|---|---|

| United States | Transitioning to digital-friendly regulations | Cybersecurity, data protection, regulatory agility |

| European Union | Fintech regulatory sandbox | Innovation, consumer protection, data privacy |

| Singapore | Smart Financial Centre initiative | Fintech development, regulatory responsiveness |

Benefits of Modernization

This image is taken from google.com

1. Fostering Innovation:

Modernized regulation can create an environment conducive to innovation. A regulatory framework that encourages experimentation while ensuring consumer protection can foster the development of new, innovative financial products and services.

2. Enhanced Risk Management:

The digital age introduces new forms of risk, from cyber threats to rapidly evolving financial products. Modernized regulation equips banks with the tools and guidelines to effectively manage and mitigate these risks, enhancing overall resilience.

Public and Industry Considerations

1. Stakeholder Collaboration:

The modernization process should involve collaboration with all stakeholders, including banks, regulators, and consumers. A transparent and inclusive approach ensures that the updated regulations address the diverse needs and concerns of the entire ecosystem.

2. Balancing Innovation and Stability:

Striking the right balance between fostering innovation and maintaining financial stability is a delicate challenge. Modernized regulation should navigate this balance, allowing for progress while preventing excessive risks that could destabilize the financial sector.

Conclusion

As the United States confronts the imperative to modernize its bank regulation, the journey into the digital age promises a more agile, innovative, and secure financial landscape. The benefits of adapting to contemporary challenges and opportunities position the financial sector for sustained growth, efficiency, and resilience in the evolving world of digital finance.

Leave a Comment

Your email address will not be published. Required fields are marked with *